Flexible Spending Account (FSA) Explained

-

By A Mystery Man Writer

-

-

4.9(108)

Product Description

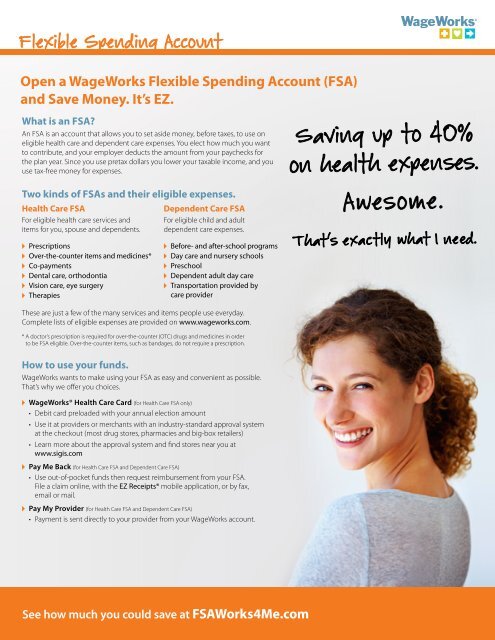

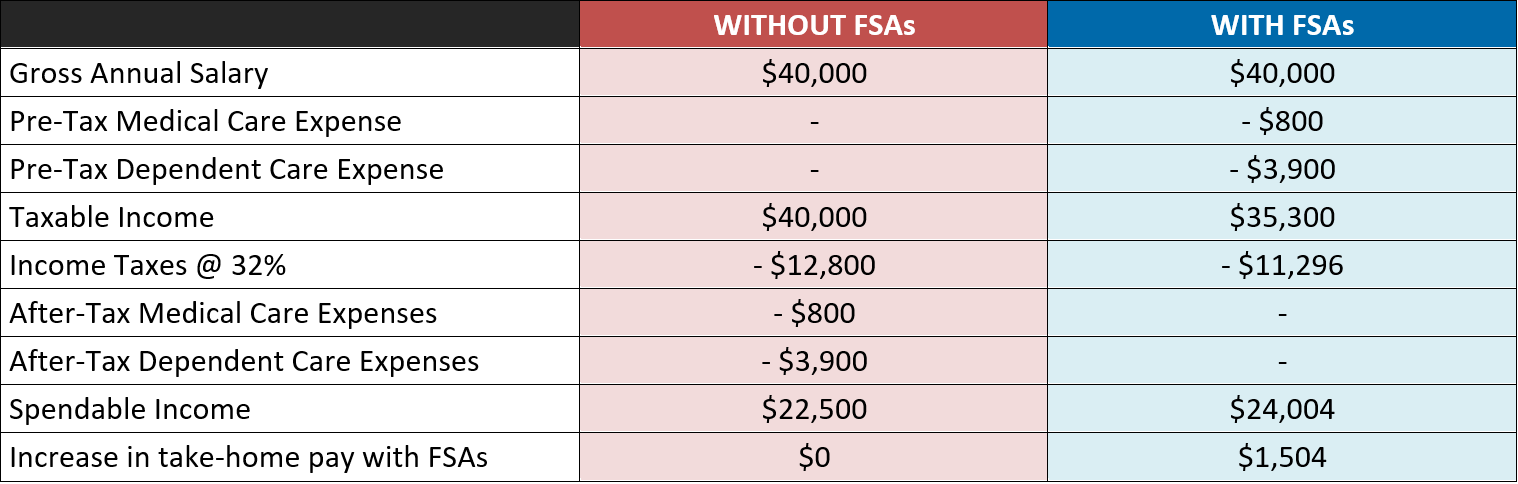

Key points: You won’t owe income taxes on the money you contribute to an FSA. You can use your FSA to pay for your out-of-pocket medical costs. The annual contribution cap is $3,050 for 2023. But it’s not always a good idea to contribute the maximum. Even when you have health insuranc.

Key points: Even when you have health insurance, you know all too well how out-of-pocket medical costs can really add up. U.S. households spent an average of $5,452 on health care in 2021, according to the latest data made available by the U.S. Bureau of Labor Statistics. That total includes about $1,000 for medical supplies […]

Flexible Spending Account (FSA) Explained – Forbes Advisor

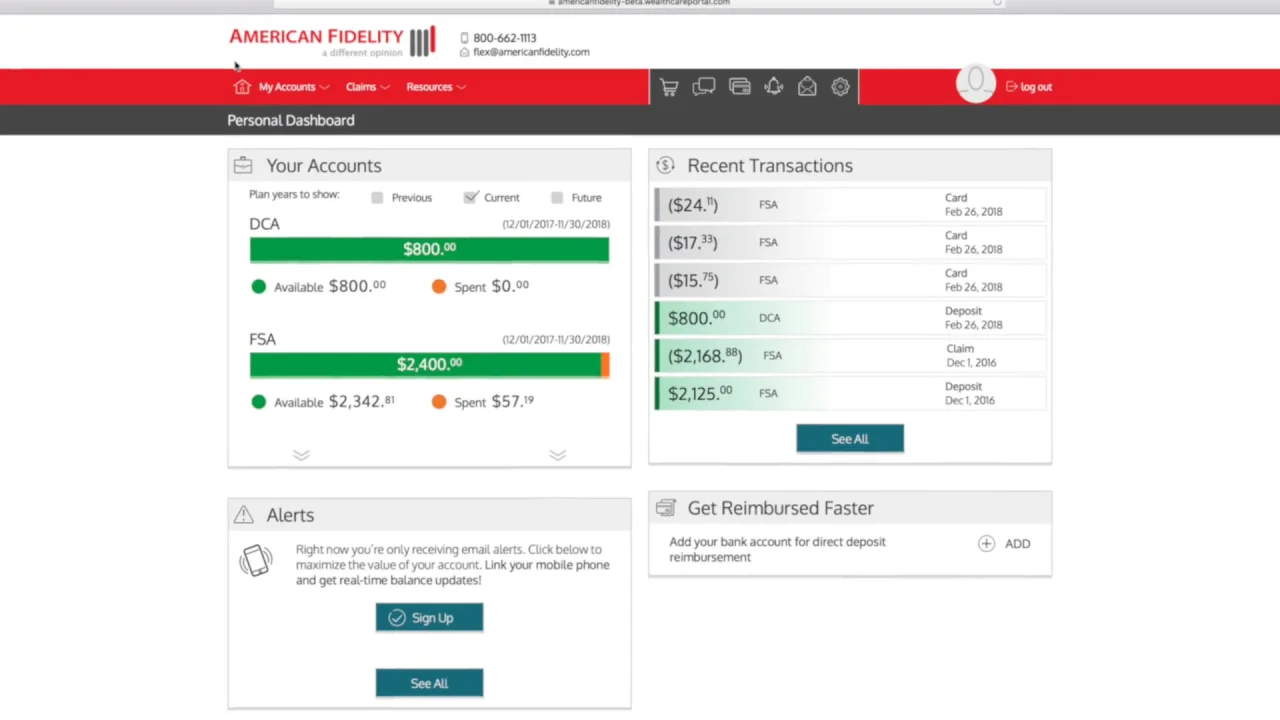

Flexible Spending Account (FSA), BRI

Flexible Spending Account Flyer

Flexible Spending Accounts — BPC - A WEX Company

Flexible Spending Accounts Amwins Connect Administrators

Flexible Spending Account An FSA is a program that allows employees to pay for certain medical, dental, vision, and dependent child care related expenses. - ppt download

How to Use Your FSA for Skincare - California Skin Institute

Information about Flexible Spending Accounts

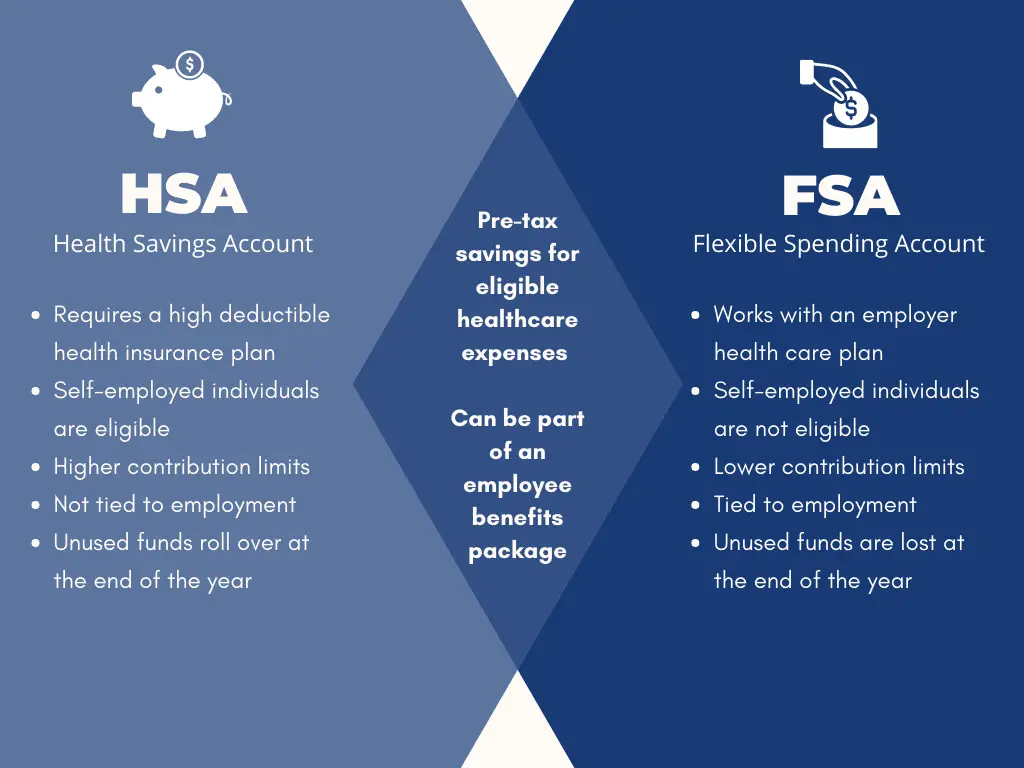

Healthcare HSA vs. FSA: Understanding The Difference - Alliance Health

California Mandates on the Flexible Spending Account (FSA)

FSA - Flexible Spending Account, Benefits

:max_bytes(150000):strip_icc()/dependent-care-fsa_final-c8b6b245dc45448aa7538bb91a854bb8.png)